The Internal Revenue Service (IRS) is making an unusual move by sending out stimulus payments to approximately 1 million taxpayers who missed claiming a significant credit on their 2021 tax returns. These individuals either overlooked or incorrectly claimed the recovery rebate credit, which was part of the third round of economic impact payments aimed at bolstering the economy during the pandemic. The IRS has initiated automatic payments, ensuring eligible recipients receive this money without needing to file an amended return. While most payments are expected to arrive by late January, some taxpayers may already find the funds in their accounts.

This special payment program targets those who filed a 2021 tax return but did not claim the recovery rebate credit they were entitled to. The IRS reviewed its internal data and identified these taxpayers, initiating automatic payments to correct the oversight. The agency is distributing around .4 billion, with an average payment of ,400 per recipient. Eligible individuals do not need to take any action to receive this money, as it will be sent directly to their bank account or mailing address on file.

The recovery rebate credit was designed to provide up to ,400 per person, with additional amounts for qualifying dependents. For a married couple filing jointly with two dependents, the maximum credit could reach ,600. However, the actual amount received depends on income levels, with higher earners seeing reduced benefits. Singles earning over ,000 and couples earning more than 0,000 were ineligible for the credit. The IRS is also alerting recipients via letters, informing them that the money is on the way. If a bank account has been closed, the IRS will reissue the payment to the taxpayer's address of record.

The recovery rebate credit was the final installment of stimulus payments issued following the onset of the COVID-19 pandemic. Initially, many people received advance payments based on their 2019 or 2020 tax information. Those who missed out on these advance payments or did not receive the full amount they qualified for could claim the credit on their 2021 tax returns. However, due to complex eligibility rules and income limits, some taxpayers inadvertently overlooked this opportunity. The IRS's proactive approach aims to rectify this situation and ensure eligible individuals receive their rightful payments.

The rules surrounding the recovery rebate credit were intricate, leading to confusion among taxpayers. For instance, parents of newborns in 2021 and college graduates who became independent filers that year might qualify for the credit. Additionally, those whose income dropped significantly in 2021 compared to previous years could still be eligible. Despite the complexity, the IRS emphasizes that no one needs to repay previously received payments if their income increased in 2021, ensuring the reconciliation process favors taxpayers. This initiative underscores the IRS's commitment to assisting eligible taxpayers and addressing past oversights.

Elon Musk's Gaming Controversy: Admitting to Cheating in High-Stakes Video Games

Elon Musk admitted to cheating in video games to achieve high scores, as revealed in a private onlin

Embracing the Charm of Countryside Elegance: A Modern Winter Wardrobe

Countryside style emerges as a prominent winter fashion trend, blending bohemian, preppy, and equest

Wildfires Devastate Pacific Palisades: A Community and Its Businesses Struggle to Rebuild

The wildfires in Pacific Palisades have caused extensive damage, displacing residents and devastatin

Unveiling the Artistry: A Deep Dive into Autumn/Winter Fashion Trends

This Autumn/Winter 2024 issue of AnOther Magazine showcases a striking fashion spread featuring a mo

Reviving Fashion Trends: Claudia Winkleman's Impact on Leggings

Claudia Winkleman's styling on *The Traitors* is reviving the popularity of Spanx leggings, transfor

Timothée Chalamet Enlists Lookalikes for SNL Hosting Duties

Timothée Chalamet will host and perform as the musical guest on this week’s "Saturday Night Live,

Capitol Theatre to Showcase Restored Sci-Fi Masterpiece

The Capitol Theatre in Rome will screen Stanley Kubrick’s iconic sci-fi masterpiece, *2001: A Spac

Australian Open Thrives Amidst Record Attendance and Crowd Management Challenges

Australian Open Tournament Director Craig Tiley has dismissed concerns about worsening crowd behavio

New Office, New Neighborhood: Exploring Culinary Delights in the Design Center

Moving to a new office in the Design Center has introduced the team to nearby dining spots like Pizz

Tragic Incident Shocks Warner Robins Community

The Warner Robins Police Department (WRPD) is investigating a homicide-suicide that resulted in thre

Americans Struggle to Keep Pace with Inflation Amidst Banking Choices

A recent WalletHub survey reveals that 65% of Americans feel their bank accounts aren't keeping up w

Direct File: A Cost-Effective Solution for Tax Filing in Hawaii

Direct File is an IRS pilot program enabling taxpayers to file their taxes online for free, bypassin

Buffalo Bills Fans Rally to Support Mark Andrews with Generous Charity Donation

In the Baltimore Ravens' divisional playoff loss to the Buffalo Bills, tight end Mark Andrews droppe

Los Angeles Wildfires: Balancing GoFundMe and FEMA Assistance for Disaster Victims

The Los Angeles wildfires, including the destructive Palisades and Eaton fires, have displaced thous

Revolutionizing Early-Stage Relapsed or Refractory Multiple Myeloma Treatment: A New Era of Care

The treatment landscape for early-stage relapsed or refractory multiple myeloma (R/R MM) has signifi

Preparation and Maintenance: The Key to Beating the Cold for Your Vehicle

In Kearney, Nebraska, extreme cold temperatures not only affect human health but also vehicle perfor

Video Games as a Beacon of LGBTQ Inclusivity and Representation

The 36th Annual GLAAD Media Awards highlight ten nominees for Outstanding Video Game, showcasing LGB

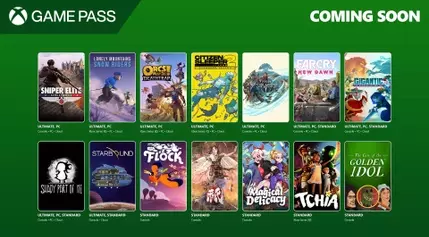

Exciting New Additions to Xbox Game Pass Set to Delight Players

Xbox has announced the addition of 14 new games to its Game Pass subscription service, set to roll o

The Evolution and Impact of Video Game Adaptations in Modern Media

Video game adaptations have gained prominence, particularly in television, over recent decades. Nota

Indie Developer Unveils Photorealistic FPS Game Set in Hong Kong

Indie game developer Monte Gallo unveiled a sneak peek of his upcoming brutal FPS, *Better Than Dead